by Daniel Castro, Michael McLaughlin and Eline Chivot

Many nations are racing to achieve a global innovation advantage in artificial intelligence (AI) because they understand that AI is a foundational technology that can boost competitiveness, increase productivity, protect national security, and help solve societal challenges. This report compares China, the European Union, and the United States in terms of their relative standing in the AI economy by examining six categories of metrics—talent, research, development, adoption, data, and hardware. It finds that despite China’s bold AI initiative, the United States still leads in absolute terms. China comes in second, and the European Union lags further behind. This order could change in coming years as China appears to be making more rapid progress than either the United States or the European Union. Nonetheless, when controlling for the size of the labor force in the three regions, the current U.S. lead becomes even larger, while China drops to third place, behind the European Union. This report also offers a range of policy recommendations to help each nation or region improve its AI capabilities.

Many nations are racing to achieve a global innovation advantage in artificial intelligence (AI) because they understand that AI is a foundational technology that can boost competitiveness, increase productivity, protect national security, and help solve societal challenges. This report compares China, the European Union, and the United States in terms of their relative standing in the AI economy by examining six categories of metrics—talent, research, development, adoption, data, and hardware. It finds that despite China’s bold AI initiative, the United States still leads in absolute terms. China comes in second, and the European Union lags further behind. This order could change in coming years as China appears to be making more rapid progress than either the United States or the European Union. Nonetheless, when controlling for the size of the labor force in the three regions, the current U.S. lead becomes even larger, while China drops to third place, behind the European Union. This report also offers a range of policy recommendations to help each nation or region improve its AI capabilities.The United States reaped tremendous economic benefits from the last wave of digital innovation, becoming home to some of the world’s most successful tech companies, such as Amazon, Apple, Facebook, Google, Intel, and Microsoft. Meanwhile, many parts of the world, including the European Union, paid an economic price staying on the sidelines. Recognizing that missing the next wave of innovation—in this case, AI—would be similarly problematic, many nations are taking action to ensure they play a large role in the next digital transformation of the global economy.

China, the European Union, and the United States are now emerging as the main competitors for global leadership in AI. Indeed, China, which achieved success in the Internet economy in part by shutting out U.S. firms, has clearly stated its ambition of achieving dominance in AI—both to increase its competitiveness in industries that have traditionally been vital to the U.S. and EU economies, and to expand its military power.[1] Moreover, the EU’s coordinated plan on AI states that its “ambition is for Europe to become the world-leading region for developing and deploying cutting-edge, ethical and secure AI.”[2] The outcome of this race to become the global leader in AI will affect the trio’s future economic output and competitiveness, as well as military superiority.

Findings

Overall, the United States currently leads in AI, with China rapidly catching up, and the European Union behind both. The United States leads in four of the six categories of metrics this report examines (talent, research, development, and hardware), China leads in two (adoption and data), and the European Union leads in none—although it is closely behind the United States in talent. Out of 100 total available points in this report’s scoring methodology, the United States leads with 44.2 points, followed by China with 32.3 and the European Union with 23.5.

The United States leads for several reasons. First, it has the most AI start-ups, with its AI start-up ecosystem having received the most private equity and venture capital funding.[3] Second, it leads in the development of both traditional semiconductors and the computer chips that power AI systems.[4] Third, while it produces fewer AI scholarly papers than the EU or China, it produces the highest-quality papers on average.[5] Finally, while the United States has less overall AI talent than the European Union, its talent is more elite.[6]

China is ahead of the European Union in AI and appears to be quickly reducing the gap between itself and the United States. It has more access to data than the European Union and the United States, which is important because many of today’s AI systems use large datasets to train their models accurately. In venture capital and private equity funding, Chinese AI start-ups received more funding than U.S. start-ups in 2017, but not in 2016 or 2018.[7] China, however, is clearly behind both the United States and the European Union in high-quality AI talent. Several European Union member states, including Italy, had more AI researchers ranked in the top 10 percent internationally than China as of 2017.[8] Nonetheless, China has made clear progress relative to the United States in most metrics, and significantly outpaces the European Union in funding and AI adoption.

The European Union has the talent to compete with the United States and China. Indeed, it has more AI researchers than its peers, and typically produces the most research as well.[9] However, there is a disconnect between the amount of AI talent in the EU and its commercial AI adoption and funding. For example, AI start-ups in the United States and China both received more venture capital and private equity funding in 2017 alone than EU AI start-ups received in the three years covering 2016 through 2018.[10] The European Union’s laggard position reduces its ability to not only enjoy the economic and social benefits of AI, but also influence global AI governance, which is a goal of the European Commission.[11]

Table 1: Rankings, absolute metrics

To get a sense of each region’s AI strengths in relation to their size, we also calculated scores for each metric by adjusting for the size of their labor forces. Controlling for size, the U.S. lead grows (58.2 points), the European Union ranks second (24.3 points), and China comes in third (17.5 points).

As this report demonstrates, China, the European Union, and the United States each have different areas they can improve to become more competitive in the AI economy. For example, China should expand its capacity to teach AI-related subjects at the university level, encourage research quality over quantity, and foster a stronger culture of promoting open data. Meanwhile, the EU should focus on developing policies that incentivize talent to remain in the EU, help transfer research successes into business applications, encourage the development of larger firms that can better compete in a global market, and reform regulations to better enable use of data for AI. Finally, for the United States to maximize its lead, it should focus on policies that grow its domestic talent base, enable foreign AI talent to immigrate, and increase incentives for research and development (R&D). More detailed recommendations are enumerated at the end of this report.

On the following pages, we examine the metrics and scores, by category.

Table 2: Talent metrics and scores, absolute values

Table 3: Research metrics and scores, absolute values

Table 4: Development metric and scores, absolute values

Table 5: Adoption metrics and scores, absolute values[12]

Table 6: Data metrics and scores, absolute values

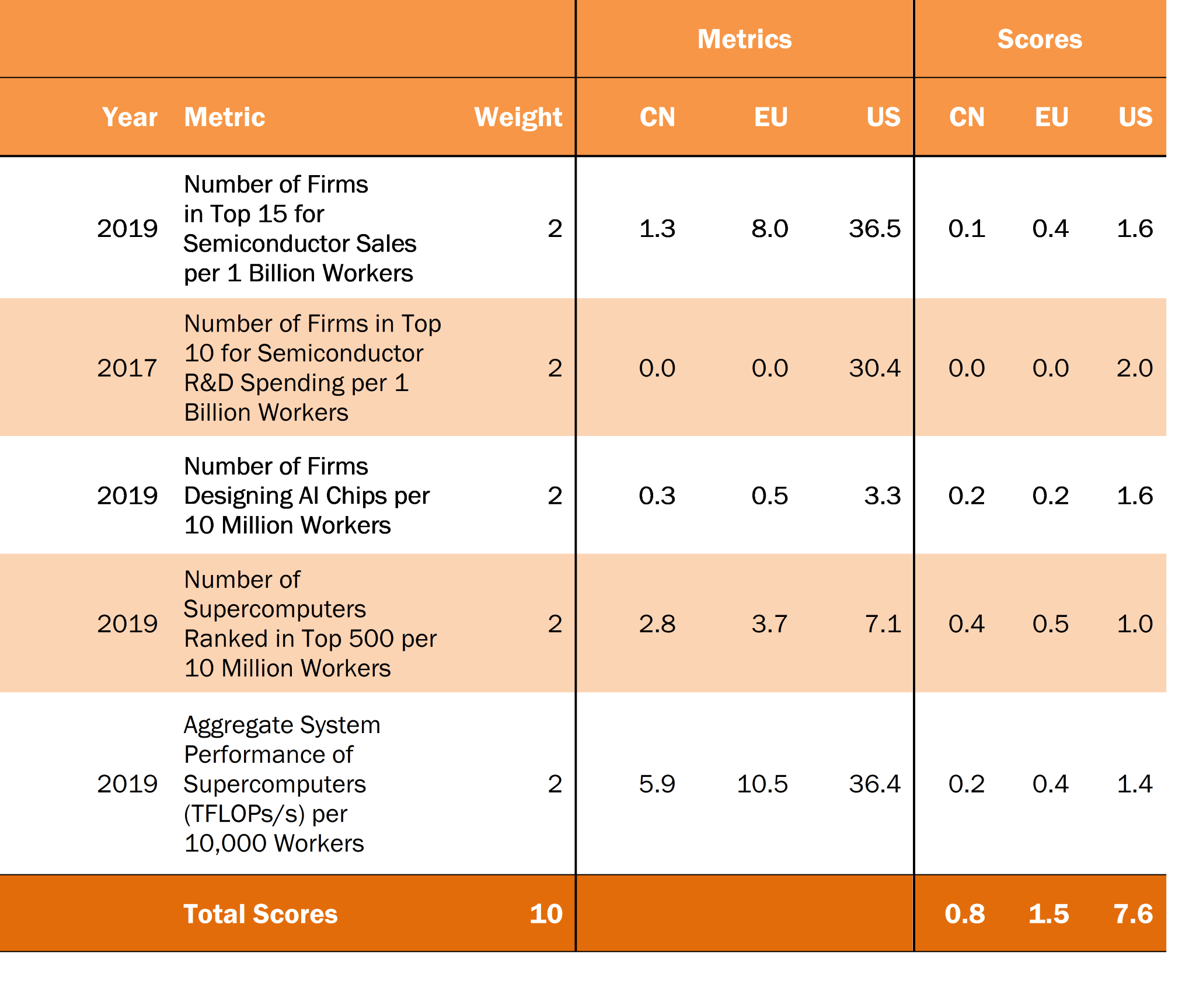

Table 7: Hardware metrics and scores, absolute values

Table 8: Talent metrics and scores, adjusted by number of workers[13]

Table 9: Research metrics and scores, adjusted by number of workers

Table 10: Development metrics and scores, adjusted by number of workers

Table 11: Adoption metrics and scores, percent values

Table 12: Data metrics and scores, adjusted by number of individuals or workers

Table 13: Hardware metrics and scores, adjusted by number of workers

Is The AI Race A Zero-Sum Game?

Many believe countries do not compete when it comes to innovation. In this view, there are only winners, no losers. But in fact, there are both winners and losers in the global AI race. Nations wherein firms fail to develop successful AI products or services are at risk of losing global market share. As Andrew Moore, former dean of computer science at Carnegie Mellon University and current head of Google Cloud AI stated, this part of the race will determine “who will be the Googles, Amazons, and Apples in 2030.”[14] Nations that lag in AI adoption will see diminished global market share in a host of industries, from finance to manufacturing to mining. And nations that underinvest in AI R&D, particularly for military applications, will put their national security at risk.[15] Consequently, nations that fall behind in the AI race can suffer economic harm and weakened national security, thereby diminishing their geopolitical influence.[16]

In some areas, however, the race to develop or adopt AI is not a zero-sum game. Developments of AI science, particularly at universities, can and do spread throughout the world, thereby helping the entire AI ecosystem. And many AI advancements, particularly those focused on health, the environment, and education, can benefit all countries. For example, the development of AI systems that can identify diseases faster and more accurately than clinicians, or produce new medical treatments, offers potentially global benefits. One such development has come in 2019, when Chinese and American researchers created an AI system that accurately diagnoses common childhood conditions. The system diagnoses asthma with more than 90 percent accuracy and gastrointestinal disease with 87 percent accuracy, and to develop it, the researchers trained the system on the electronic health records (EHRs) of 600,000 Chinese patients.[17] In addition, because much AI research is open, researchers worldwide quickly learn from advancements made by others abroad.[18]

Moreover, there are already numerous examples of AI systems created in one nation that are being implemented in others to help the local populations. For example, Google is using one of its AI tools in rural India to diagnose blindness-causing diabetic retinopathy.[19]

Methodology

There are no standard industrial classifications for firms developing AI technologies, so compiling indicators to compare AI development among nations is challenging. Nonetheless, there are a number of metrics that show the current state of AI development. This report examines six categories of metrics—talent, research, enterprise development, adoption, data, and hardware—to measure AI progress in the economies of China, the European Union, and the United States. We chose these three economies because they are the largest and consistently outperform their peers in the six categories on absolute metrics.

We chose the categories for several reasons. First, nations with the requisite AI talent will be able to better develop and implement AI systems, attract businesses, and ensure their universities have enough talented AI professors to teach the next generation of AI researchers. Second, research will help nations expand AI innovation and solve problems related to domestic priorities and industries. Third, the number of AI companies and start-ups, combined with related investment capital, lays the groundwork for a strong AI industry that will continue to innovate. Fourth, adoption of AI systems will not only allow organizations to learn how to solve problems related to implementation, but generate demand for AI services, thereby likely helping domestic AI developers. Fifth, more and higher-quality data will create new opportunities to use machine learning in AI applications. Finally, leading in hardware will reduce nations’ dependency on other nations—something that, given the current trade dispute between China and the United States, may play an important role going forward.

Within each category, we measured a nation’s progress using multiple indicators. For example, for the research category, we used the number of AI papers, the quality of the AI papers, and R&D metrics to rank China, the European Union, and the United States. For several of the indicators, complete data was not available for the European Union. For these indicators, we estimate an EU figure using available data. We detail these estimates in the appendix. We show each indicator both in absolute terms and controlling for the size of the economy. For example, AI researchers are shown both as an absolute total and as a share of the economy’s total workforce.

We calculated a score for every indicator for each region. To do so, we first calculated a proportional score. For example, on the indicator for supercomputers, China has 219 computers, the European Union has 92, and the United States has 116. Thus, China gets a proportional score of 0.5, the EU 0.2, and the United States 0.3. Each indicator is worth between 2 and 5 points. So, if the indicator for supercomputers is worth 2 points, China receives a score of 1 point, the European Union 0.4, and the United States 0.5.

We assigned different weights to different indicators based on our assessment of their relative importance in determining national AI development success. As a result, not all categories are worth the same number of points, although all indicators together are worth a total of 100 points. Appendix 1 lists the categories, indicators, and corresponding weights. For several indicators, we had to use a combination of quantitative and qualitative analysis. In these cases, we ranked the regions first, second, and third, and give their scores as the inverse of their ranking. For example, if China ranked first, it received three points.

To calculate category scores, we summed each region’s score for the indicators in the category. To calculate overall scores, we summed the category scores.

We used this method to calculate two sets of scores: one based on the absolute value of the metrics, and one adjusting each metric by the number of workers in the economy.

Metrics

The following sections compare China, the European Union, and the United States on talent, research, enterprise development, adoption, data, and hardware using absolute and size-controlling metrics. After presenting the metrics for each category, this report provides a brief analysis of the state of the AI race in each category.

Talent

Researchers are key to AI development.[20]As David Wipf, a lead researcher at Microsoft Research in Beijing has said, “The future [of AI] is going to be a battle for data and for talent.”[21] Lack of talent not only limits firms’ ability to deploy and adopt AI,it increases costs, thereby reducing competitiveness. Given the increased demand for AI talent in a wide range of industries, including transportation, finance, and manufacturing, the current shortage is likely to only grow in the near to moderate term.[22]

Governments in China, the European Union, and the United States have announced or begun initiatives to improve and expand their AI talent. For example, in 2018, China’s Ministry of Education announced a plan to promote AI education. In response, several leading Chinese universities have created new AI departments and majors.[23] The U.K. government has announced that it will pay up to £115 million ($129 million) for 1,000 students to earn AI doctorate degrees at 16 of its universities.[24] President Trump issued an executive order that focuses on measures to expand fellowships, training programs, and funding for early-career university faculty conducting AI R&D.[25]

This section analyzes the number of AI researchers, the number of top AI researchers, and the locations of AI researchers’ graduate degrees to assess the talent and ability to develop talent in China, the European Union, and the United States. We allotted this category 15 of the 100 available points. On an absolute basis, the most recent data available showed the United States leading in AI talent (6.7 points) followed by the European Union (6.2) and China (2.1). Controlling for the size of their labor force, the United States (8.4 points) also led the European Union (5.8) and China (0.9).

Number of AI Researchers: This section defines an AI researcher as someone who has published a journal article or had a patent on an AI-related topic between 2007 and 2017.[26] The European Union had an estimated 43,064 researchers, ahead of the United States (28,536) and China (18,232).[27] Indeed, the combined number of AI researchers from Germany (9,441), the United Kingdom (7,998), France (6,395), Spain (4,942), and Italy (4,740) was more than that of U.S. researchers.[28] On a per-worker basis, the United States (173 researchers per 1 million workers) led the European Union (173) and China (23).[29]

Table 14: Number of AI researchers, 2017[30]

Number of Top AI Researchers (H-Index): It is not just the number of researchers that matters, but their quality. One measure of quality is the h-index, which measures the productivity and influence of researchers. This indicator examines the number of AI researchers ranking in the top 10 percent internationally according to their h-index.[31] Through 2017, the European Union led with an estimated 5,787 researchers, ahead of the United States (5,158) and China (977). The United Kingdom (1,177), Germany (1,119), France (1,056), Italy (987), and Spain (772) combined for 5,111 such individuals.[32] While the data for the other 23 EU nations was unavailable, it is clear there was enough top AI talent in the remaining countries to eclipse the less-than-100-person gap between the United States and European Union. When controlling for workforce sizes, the United States (31 researchers per million workers) led the European Union (23) and China (1).[33]

Table 15: Number of top AI researchers (h-index), 2017[34]

Number of Top AI Researchers (Academic Conferences): A second measure of quality is the number of authors publishing at leading AI academic conferences around the world, which AI start-up Element AI tracked for 21 AI conferences in 2018. In this metric, the United States (10,295 researchers) led the European Union (4,840) and China (2,525).[35] On a per-worker basis, the United States (62 researchers per one million workers) led the European Union (19) and China (3).[36]

Table 16: Number of top AI researchers (academic conferences), 2018[37]

Educating Top AI Researchers (Academic Conferences): Developing AI talent is also important. This indicator examines where the researchers publishing at the 21 leading academic conferences in 2018 earned their Ph.D. More of the researchers earned their Ph.D. in the United States (44 percent) than the European Union (estimated 21 percent) and China (11 percent) combined.[38] This provides the United States an advantage in AI talent in large part because 79 percent of students receiving a Ph.D. in the United States in mathematics or computer science plan to stay in the United States.[39] We could not compute an exact per-worker stat for this indicator, but the size of the labor forces indicate that the United States would lead on a per-worker basis, followed by the European Union, and China.[40]

Table 17: Educating AI researchers, 2018[41]

Interpretation: The EU Is Not Taking Advantage Of Its AI Talent And Its Position Is Not Safe

The European Union is a close second in AI talent, but it may continue to fall behind in commercially leveraging AI because it has less AI talent in businesses than the United States, the United States is attracting significant amounts of foreign talent (including European talent), and China is implementing robust plans to increase its AI talent.

The EU Has Less AI Talent Working in Globally Leading Firms

The data reveals that while the European Union has lots of AI talent, its top businesses have less talent than U.S. firms, which, combined with a lack of venture capital and private equity funding, could hurt its ability to develop globally leading AI firms. For example, of the 20 companies with the most AI talent, according to AI paper and patent records, in 2017, half were based in the United States.[42] These ten U.S. companies combined for 1,623 AI workers. In comparison, the European Union had six such companies, totaling 522 AI workers. The only Chinese company ranking in the top 20 was Huawei, with 73 workers. Similarly, of the 20 companies with the most top AI researchers, according to their H-index, in 2017, the European Union accounted for 85 individuals, compared with 232 for the United States. China accounted for seven researchers.[43]

The United States Is Attracting the Most AI Talent

Another concern for the European Union, as well as China, is U.S. industry is attracting significantly more AI talent from other nations than the European and Chinese industries. Between 1998 and 2017, for example, 1,283 foreign AI academic researchers came to the United States from abroad for U.S. industry positions. Europe and China attracted 834 and 58 such researchers, respectively.[44] Moreover, data collected by Elsevier demonstrates that U.S. industry (318 AI researchers) gained more foreign academic researchers than researchers it lost to foreign academic institutes than European industry (166) between 1998 and 2017.[45]

China Is Working Extensively to Develop AI Talent

Compared with China, the EU has many advantages in AI talent. For example, in 2017, the United Kingdom (1,177), Germany (1,119), France (1,056), and Italy (987) each had a greater number of AI researchers ranking in the top 10 percent internationally according to their h-index than China (977).[46] However, China’s lack of top AI talent may be due to its relatively recent interest in AI—only 25 percent of Chinese AI researchers have more than ten years of experience compared with nearly 50 percent of U.S. AI researchers.[47] In addition, there are several reasons why China may be able to reduce both the talent gap and the talent gap may have diminishing importance.

First, China is investing in AI education. In 2017, the State Council, the chief administrative body in China, released a plan calling for the creation of an AI academic discipline.[48] In 2018, the Ministry of Education launched multiple initiatives to boost education, and the combined initiatives include plans to develop 50 AI research centers, world-class online courses, and a 5-year plan to train more than 500 instructors and 5,000 students.[49] Three of China’s top universities—Tsinghua University, USTC, and Shanghai Jiao Tong University—have already significantly increased the number of students enrolled in AI and machine learning courses since 2016. For example, between 2016 and 2018, USTC increased its AI and machine learning course enrollment from 1,745 to 3,286 students.[50] Second, Chinese researchers can and do quickly replicate advanced algorithms developed by other nations because AI researchers frequently detail the architecture of their AI model, and how they implemented and trained it, on openly available prepublications websites.[51] Anecdotal evidence also suggests Chinese researchers translate English AI publications significantly more often and faster than Western nations translate papers in Chinese, thereby creating an information asymmetry.[52] Third, AI researcher and venture capitalist Kai-Fu Lee has argued that China’s lack of top-end talent is not a significant barrier to it leading in AI, stating “[T]he current age of implementation [AI application commercialization] appears well-suited to China’s strengths in research: large quantities of highly-skilled, though not necessarily best-of-best, AI researchers and practitioners.”[53] Lee believes breakthroughs such as deep learning occur once every several decades, and AI has entered an age in which data will be the decisive factor that determines the ability of AI systems.[54]

Research

Countries need organizations to perform research in order to sustain innovation. In the past decade, algorithmic innovations, along with greater computing power, have increased the functionality of AI systems and drastically reduced the time it takes to train them.[55] But AI is far from a mature technology; more research and more advances are needed.

This section analyzes the number and quality of AI scholarly papers and business R&D funding to assess China, the European Union, and the United States. Ideally, the study would also include government R&D funding. However, nations have different classifications of what constitutes AI R&D, and some do not report AI R&D figures or distinguish between private and public money in their announcements.

Nonetheless, China, the European Union, and United States are each conducting AI research initiatives. For example, China’s New Generation AI Development Plan calls for China to have made significant breakthroughs in AI theory by 2025, and the government has created research centers, including the Artificial Intelligence Research Center, which has more than 100 employees, to reach that goal.[56] In addition, the Chinese Ministry of Industry and Information Technology plans to allocate $950 million annually to fund strategic AI projects.[57] The European Commission has committed to invest €1.5 billion ($1.7 billion) on AI research between 2018 and 2020, and proposed to invest at least €7 billion ($8 billion) from 2021 to 2027 through Horizon Europe and the Digital Europe Program in AI.[58] The U.S. federal government spent $1.1 billion on unclassified R&D for AI-related technologies in 2015.[59] Additionally, in September 2018, the Defense Advanced Research Projects Agency, part of the U.S. Department of Defense (DOD), announced a $2 billion campaign over 5 years to develop the next generation of AI technologies.[60]

We allotted the research category 15 of 100 available points. On an absolute basis, the United States led in AI research (7.6 points), followed by the European Union (3.8 points) and China (3.6 points). Controlling for the size of the workforces, the United States ranked first (9.3 points), followed by the European Union (3.9) and China (1.8).

Number of AI Papers: One indicator of research is the number of AI papers a nation produces each year. In 2017, China published 15,199 AI papers, the European Union 14,776, and the United States 10,287.[61] Historically, however, the EU has produced the most AI papers. From 1998 to 2017, for example, EU researchers authored nearly 164,000 AI papers, compared with 135,000 and 107,000 by Chinese and U.S. authors, respectively.[62] On a per-worker basis, the United States published 63 AI papers per one million workers in 2017, ahead of the European Union (59) and China (19).[63]

Table 18: Number of AI papers, 2017[64]

Paper Quality: As the Allen Institute for Artificial Intelligence has written, “[N]ot all papers are created equal.”[65] Indeed, the United States produces the highest-quality research.[66] In 2016, the United States had a rebased field-weighted citation impact (FWCI) of 1.83, which means researchers cited U.S. authors 83 percent more than the global average.[67] In comparison, the EU and China had FWCIs of 1.20 and 0.94, respectively, which shows Chinese authors were cited less often than the average AI author globally.[68] China has, however, increased its FWCI every year since 2012, when it was 0.71.[69]

Figure 1: Field-weighted citation impact, 1998–2016[70]

Top 100 Software and Computer Service Firms for R&D Spending: Another way to measure a region’s research capabilities is to examine how much it spends on R&D. It is difficult to know how much firms are spending specifically on AI R&D, but examining the overall R&D expenditures of software and computer services firms, many of which are developing AI services, provides a proxy for AI R&D spending. This indicator examines the top 100 software and computer service firms for R&D spending in 2018. The United States (62 firms) led the European Union (13), and China (12).[71] Per 10 million workers, the United States also led the EU and China.

Table 19: Top-100 software and computer services firms for R&D spending, 2018[72]

Total R&D Spending of Software and Computer Services Firms Ranking in Top 2,500 Globally: There were 268 software and computer services firms in the global top 2,500 firms for R&D spending in 2018. This indicator measures how much the 268 firms spent on R&D by region.[73] The United States (€69 billion, $77 billion) led China (€10 billion, $12 billion) and the European Union (€9 billion, $11 billion).[74] On a per-worker basis, the United States ($470 per worker) led the European Union ($42) and China ($15).[75]

Table 20: R&D spending by software and computer services firms ranking in global top 2,500, 2018[76]

Interpretation: The United States Is Leading In AI research, But China Is Catching Up

An analysis of the data shows the United States leading in AI research, both because of its immense spending on R&D and its elite research organizations. Nonetheless, China is catching up to the United States and European Union not only because it produces more research, but because it has begun producing higher-quality research.

The United States Has Elite Research Organizations

The United States leads in research in part because it has elite organizations. For example, the top-five software and computer services firms for R&D are U.S. firms. Another way to assess the quality of research a nation produces is to examine the impact of its organizations publishing the most AI papers. The United States leads in this measure as well. U.S.-based organizations that published the most AI papers between 2013 and 2017 were Carnegie Mellon University, the Massachusetts Institute of Technology, Microsoft, IBM, and Stanford University. Collectively, these five- organizations had an FWCI of 4.0, which was significantly higher than the FWCI of the top-five EU (1.9) and Chinese (1.4) organizations.[77]

The EU’s Second-Place Position Is Not Secure

While the EU’s top organizations are producing higher-quality research on average than the best Chinese organizations, the EU is nonetheless experiencing relative stagnation in paper output and quality. Since 1998, the European Union’s FWCI has grown only 11 percent, compared with 24 percent for the United States and 154 percent for China.[78] Maintaining the same rapid increase in FWCI as it experienced between 2012 and 2016, China may have surpassed the EU in FWCI by 2018 (data was only available through 2016).[79] In addition, five nations—the United Kingdom, Germany, France, Spain, and Italy—primarily drive AI research in the EU, but their annual AI publication output has actually contracted since 2014.[80]

China’s Research Quality Is Rising

The EU’s stagnation is coupled by a rising China. While the FWCIs for the United States and European Union in 2009 were almost identical to their FWCIs in 2016 (1.82 and 1.83 for the United States, and 1.21 and 1.20 for the EU), China’s FWCI grew from 0.59 to 0.94 in the same period.[81] Consequently, China’s FWCI is rapidly approaching, or has surpassed, the global average of 1.00.[82]

China also does not need to match the FWCI of the United States to produce more substantial research because it produces such a large amount of it. For example, a recent analysis of AI papers by the Allen Institute for Artificial Intelligence (AI2) found that the U.S. share of the 10 percent most cited AI papers shrank from 47 percent in 1982 to 29 percent in 2018. China’s share, however, has grown to 26.5 percent, from roughly 0 percent in 1982.[83] AI2’s research suggests China will surpass the United States in producing papers ranked in the top 10 and 1 percent of all AI research papers by 2020 and 2025, respectively.[84] While China’s number of citations may be inflated by self-citation, which is when an article cites another article in the same journal, the quality of Chinese research has increased both absolutely and relative to the United States and the European Union.[85]

Development

To experience the full benefits of AI, nations must have healthy AI ecosystems that lead to the development of innovative AI technologies and firms. For example, nations must have sufficient venture capital and private equity funding to connect inventors with the money, expertise, and contacts necessary to develop and sell their products or services.[86] In addition, the number of firms indicates the health of a nation’s ecosystem. Finally, patents indicate the ability of a firm or nation to innovate. This section analyzes AI venture capital and private equity funding, the acquisitions of AI firms, the number of AI firms, and patent data to compare China, the European Union, and the United States.

The governments of China, the European Union, and the United States have each focused on developing AI firms, including by providing funding to AI start-ups. For example,China partially funds private equity firms such as Canyon Bridge, and the Guangzhou Municipal Government provided a $301 million grant to CloudWalk, which develops facial recognition software, in 2017.[87] The EU Commission is using the European Fund for Strategic Investments to address market failures and stimulate private investment in AI. It created VentureEU, a venture capital fund, to provide up to €410 million ($459 million) to start-ups, including AI start-ups.[88] Lastly, In-Q-Tel, a U.S. government taxpayer-funded venture capital firm, has invested in at least 10 AI firms, including Forge.ai, which creates technology to transform unstructured information into machine-ready data, and Mythic, which creates computer chips for AI applications.[89]

We allotted the development section 25 of the 100 available points. On an absolute basis, the most recent data available showed the United States (14.9 points) leading the European Union (5.3 points) and China (4.8 points). Controlling for the size of their economies, the United States (19 points) led the European Union (4.5) and China (1.4).

Total Venture Capital and Private Equity Funding (2017–2018): Tracking private funding is one way to measure the ability of nations to develop AI firms. This indicator measures venture capital and private equity funding for AI firms between 2017 and 2018. The United States (estimated $16.9 billion) led, followed by China (estimated $13.5 billion) and the European Union (estimated $2.8 billion).[90] On a per-worker basis, the United States led significantly over China and the European Union.[91]

Our overall findings align with research done by multiple groups, including the Organization for Economic and Cooperative Development (OECD), which also found the United States received the most funding over the last three years.[92] In addition, data from PitchBook, a private-capital market-data provider, confirmed that the United States, followed by China and the European Union, led in private equity and venture capital funding.[93]

Table 21: AI venture capital and private equity funding (2017–2018)[94]

Number of Venture Capital and Private Equity Funding Deals (2017–2018): AI Venture capital and private equity funding can be concentrated in a few a large deals, which is why it is not only important to measure the level of venture capital and private equity funding in dollar amounts, but to also track the overall number of venture capital and private equity funding deals. Between 2017 and 2018, U.S. AI firms received the most investments (1,270 deals) ahead of the European Union (660) and China (390).[95] Per one million workers, the United States (8 deals) led the European Union (3) and China (0.5).

Table 22: Number of venture capital and private equity funding deals, 2017–2018[96]

Acquisitions (2000–2019): Firms can bolster their ability to develop AI products and services through acquisitions. This indicator tracks the number of acquisitions of firms in the AI category group on CrunchBase by region from January 2000 through May 2019. U.S. firms (526 acquisitions of AI firms) were ahead of both EU (139) and Chinese firms (9).[97] Per one million workers, U.S. companies had made three acquisitions while both EU (O.6) and Chinese (0.01) companies had made fewer than one acquisition each.[98]

Table 23: Number of acquisitions of AI firms (January 2000–May 2019)[99]

Number of AI Start-ups (2017): Similar to other technology-based start-ups, AI start-ups can be an important driver of a nation’s economic growth and competitiveness.[100] Roland Berger, a global consultancy, and Asgard, a Berlin-based investment firm, categorized AI start-ups as firms that produce a primary product or service that utilizes AI, excluding hardware. The firms’ research found that the United States was home to 1,393 AI start-ups in 2017, ahead of the European Union (726 start-ups) and China (383 start-ups).[101] Per one million workers, the United States led (8), followed by the European (3) and China (0.5).[102]

Table 24: Number of AI start-ups, 2017[103]

Number of AI Companies (2019): It is not just the number of AI start-ups that matters, but also the number of well-funded AI firms, including start-ups. This indicator tracks the number of firms in the AI category group on CrunchBase that have received at least $1 million in combined funding, whether that funding be venture capital, private equity, debt financing, grants, etc. The United States (1,727 firms) has more such firms than the European Union (762) and China (224) combined.[104] Per one million workers, the United States leads (10), followed by the European (3) and China (0.3).[105]

Table 25: Number of AI companies, 2019[106]

Number of Highly Cited AI Patent Families (1960–2018): One measure of innovation is patents. However, using patents to measure innovation is difficult, in part because national standards for granting patents differ. Many patents issued by the Chinese Patent Office are of relatively poor quality, and therefore patent counts from China cannot be compared easily against patents issued by the U.S. Patent and Trademark Office (USPTO) or from European patent offices.[107] Indeed, just 4 percent of AI patents first filed in China were also filed in another jurisdiction, compared with 32 percent of patents first filed at the USPTO—which is an indicator of the significantly higher quality of U.S. patents.[108]

As a result, this report primarily focuses on Patent Cooperation Treaty (PCT) patent applications and highly cited patent families, which are patents filed for the same invention in numerous jurisdictions.[109] Between 1960 and 2018, patent applicants filed 28,031 highly cited patent families at the USPTO, which was significantly more than the number of highly cited patent families filed at EU (2,985) and Chinese (691) offices.[110] While this metric reveals where applicants filed patents, and not their location, most applicants typically first file in the nation in which they reside.[111] Per one million workers, the United States led (170 patent families) the European Union (12) and China (4).[112]

Table 26: Number of highly cited AI patents, 1960–2018[113]

Number of PCT AI Patent Applications (1960–2018): Another measure of patents is patents filed under the international Patent Cooperation Treaty (PCT). In this indicator, the World Intellectual Property Organization (WIPO) tracked the number of AI patents first filed between 1960 and 2018 as PCT patents. The United States (1,863 filings) led China (1,085) and the European Union (1,074).[114] Per one million workers, the United States (11 PCT applications) led the European Union (4) and China (1).[115] According to WIPO, not all patents included the address of the applicant. Consequently, these figures are likely deflated.

Table 27: Number of PCT patent applications, 1960–2018[116]

Interpretation: The United States is Leading, And China May Soon Surpass the EU

The United States led in every AI-development indicator, suggesting it is better positioned than China and the European Union to continue to develop leading global firms in AI. Patent and acquisition data also reveals that the United States already has a significant lead in developing world-class AI firms. However, China, partially due to its robust venture capital and private equity ecosystem, is catching up to the EU and the United States. On the contrary, the EU, despite currently ranking slightly higher than China in AI development, likely lacks the funding to seriously challenge U.S. supremacy.

The United States Is Already Leading in Developing World-Class AI Firms

U.S. firms perform strongly in patents and dominant AI acquisitions. For example, Microsoft and IBM have applied for more patents than any other entity in 8 of 15 subcategories of machine learning, including supervised learning and reinforcement learning. The Chinese Academy of Sciences has applied for the most patents in deep learning, however, and Siemens (Germany) has applied for the most patents in neural networks. [117] Nonetheless, a U.S. firm leads in patent applications in 12 of 20 fields, including agriculture (John Deere), security (IBM), and personal devices, computing, and human-computer interaction (Microsoft).[118] In addition, between 2012 and 2016, IBM led in AI patent applications (3,677) globally, with Google parent company Alphabet (2,185) and Microsoft (1,952) ranking in the top five.[119]

Table 28: All-time leaders in AI patent families by application field[120]

In addition, all ten of the companies that lead in AI company acquisitions are based in the United States. The leading companies include Alphabet (19), Apple (16), Microsoft (10), Amazon (7), and Facebook (7).[121]

Table 29: Number of AI acquisitions by top acquirers, January 2000–May 2019[122]

These acquisitions have bolstered U.S. firms, with multiple of the acquired companies having provided significant research and commercial offerings since their purchase. For example, Alphabet acquired DeepMind, one the world’s leading AI organizations, for $500 million in 2014.[123] Since its acquisition, DeepMind has developed an AI system that can analyze eye scans to make diagnoses (e.g., hemorrhages), increased the value of wind energy from Google turbines by 20 percent using AI, and released an interactive dataset of more than 100,000 panoramic images to advance the development of AI systems that can navigate using visual cues instead of maps.[124] Similarly, Apple acquired Siri for $200 million in 2010, and Amazon acquired Evi Technologies for $26 million in 2013.[125] Amazon used its acquisition’s technology to develop its virtual assistant, Alexa, and has since sold more than 100 million devices that incorporate it.[126]

World-leading firms, coupled with ample funding for start-ups, means the United States is well positioned for multiple models of AI adoption. In the first model, firms mostly adopt general-purpose, standardized AI services.[127] Similar to China, the United States has large technology firms, including Google and Amazon, that are providing these services. In the second model of adoption, AI start-ups focused on creating products and services to solve specific problems, such as drone delivery, disrupt traditional businesses using AI.[128] The United States is well positioned in this AI-uptake scenario as well because of its breadth and depth of well-funded AI start-ups.

China is Catching Up

While the United States may be in the lead in AI development, it is not clear it will maintain its lead. Multiple analyses of funding data for AI start-ups, including this one, have found at least one year where Chinese AI start-ups received more funding than U.S. start-ups. For example, Chinese AI start-ups received an estimated $8.1 billion in investment in 2017, compared with an estimated $6.2 billion for U.S. start-ups.[129] In addition, research by Tencent, a Chinese technology company, found the average time for an AI start-up to receive investment was 14.8 months in the United States, compared with 9.7 months in China.[130]

China has also begun to close its large gap to the United States in terms of the number of investments in AI start-ups, reducing the difference from 476 investments in 2016 to 371 in 2018.[131] The smaller gap is both due to significant growth in the number of investments in Chinese start-ups and relatively stagnant growth in the number of deals involving U.S. AI start-ups. U.S. AI start-ups did receive a record amount of investment in 2018, however, receiving an estimated $10.7 billion in investment, while Chinese AI start-ups received an estimated $5.4 billion in funding.[132] Data on financing in 2019 should help clarify whether the United States will be able to maintain its lead, or China will be able to match, or surpass, the United States in funding consistently.

EU Firms Lack Large Funding Deals

While private equity and venture capital funding for EU AI start-ups nearly tripled between 2016 and 2018, the European Union is firmly behind the United States and China.[133] For example, the United States received more funding in any year between 2016 and 2018 than the European Union received in the three years combined.[134] Similarly, Chinese AI start-ups received billions of more dollars in private equity and venture capital funding than the EU in both 2017 and 2018. Unless EU start-ups begin to garner significantly more funding, the European Union is at risk of falling further behind the United States and China.

It is difficult for the European Union to compete against the United States and China in AI funding in part because its investments, while noteworthy in number, are typically smaller. For example, a vast majority (70 percent) of EU’s 2018 private equity and venture capital funding AI was through seed or angel rounds (rounds in which investors help new and small companies gain traction).[135] Indeed, roughly 45 percent of investments made in U.S. or Chinese AI start-ups in 2018 were part of seed or angel rounds. Due to the high risk of firms seeking such seed or angel funding not succeeding, the rounds typically involve transactions that total between $10,000 and $2 million. In contrast, Series C funding rounds, which are for more-established companies, are usually at least $10 million, and are often much larger. For example, the average Series C deal for a U.S. AI company in 2018 was nearly $61 million.[136] The EU lacks such transactions, however—only 1 percent of deals going to EU AI start-ups in 2018 were part of a Series C round, compared with 5 percent and 6 percent in the United States and China.[137] In addition, EU funding deals are almost always smaller on average, no matter the funding stage. For example, between 2016 and 2018, the average size of Chinese deals was larger than EU deals at the seed/angel, Series A, Series B, and Series C stages.[138] Similarly, the median U.S. deal has been larger than the median EU deal the past three years. These figures match anecdotal accounts that characterize Europe’s start-up market as traditionally fraught with barriers, even though it is improving. For example, Irina Haivas, a principal at Atomico, a global technology investment firm, noted that in Europe there are barriers “to tech transfer and IP, access to funding to scale capital-intensive, research-based businesses, and to some degree, a perception barrier around the feasibility of ‘commercially-driven,’ non-academic careers.”[139]

Adoption

Technological innovation is key to raising standards of living, and AI is likely to be a primary driver of technological innovation in the emerging innovation wave.[140] Indeed, AI adoption is estimated to create $13 trillion of gross domestic product (GDP) growth by 2030.[141]Firms increasingly need to adopt AI in order to remain competitive in the global economy because it allows them to automate and optimize many facets of their business, derive faster and more accurate insights from data, and develop new products and services. As a result, countries where businesses are late adopters will lag in the global economy.[142] In addition to the economic gains, AI stands to enable important societal gains, such as reducing automobile accidents and injuries and enabling better treatment of diseases.[143]

The governments of China, the European Union, and the United States have each publicly recognized the importance of AI adoption. For example, China’s Ministry of Industry and Information Technology released the “Three-Year Action Plan for Promoting the Development of a New Generation of Artificial Intelligence Industry (2018–2020)” in 2017, which called for the integration of AI in the manufacturing industry.[144] In addition, the EU’s coordinated plan on AI calls for the creation of “common European data spaces” in sectors such as manufacturing and energy to support the development and adoption of AI.[145] Lastly, U.S. President Trump issued an executive order in 2019 that called for the creation of technical standards to enable the adoption of AI.[146]

To assess the level of AI adoption in China, the European Union, and the United States, we analyzed surveys regarding AI adoption. We allotted this section 10 of 100 available points. On an absolute basis, China led (7.7 points) over the European Union (1.3) and United States (1). In terms of the percentage of firms adopting or piloting AI, China led (4.7 points), followed by the United States (2.9 points) and the European Union (2.5 points).

Percentage of Firms That Are Adopting AI: The first way to measure AI adoption is to track the percentage of firms that are successfully adopting AI into their business processes. In 2018, China (32 percent of firms) led in this indicator, followed by the United States (22 percent) and European Union (estimated 18 percent).[147]

Table 30: Percentage of firms adopting AI, 2018[148]

Percentage of Firms Piloting AI: A second way to measure AI is to track the percentage of firms that are piloting AI. This metric tracks firms that were piloting AI initiatives as of September and October 2018.[149] In this metric, China also led (53 percent of firms), followed by the United States (29 percent) and the European Union (estimated 26 percent).[150]

Table 31: Percentage of firms piloting AI, 2018[151]

Interpretation: The Chinese People’s Views of AI May Be Spurring Adoption

While different surveys have found varying rates of adoption, they indicate similar trends: China is adopting AI at a faster rate than the United States and the European Union.[152] China may be ahead in AI adoption in part because its people and businesses recognize the value of AI at higher rates.

Chinese Individuals Believe in the Value of AI

Unlike the United States and the European Union, China’s adoption scores are relatively uniform no matter the business sector. For example, the percentage of U.S. firms active in AI, meaning they are adopting or piloting AI, varies as much as 32 percentage points between different sectors. Yet, China’s share of active AI firms varies only as much as 6 percentage points between the highest- and lowest-adopting sectors.[153]

Figure 2: Percentage of firms that have adopted AI or are piloting AI in China and the United States by industry, 2018[154]

There are several possible explanations for this phenomenon. The first is that the importance of AI has permeated Chinese culture. Indeed, in the public sector, Chinese mayors and other local officials began rushing to invest in AI start-ups and adopt AI following the release of the State Council’s “New Generation of Artificial Intelligence Development Plan” in 2017.[155] By embracing AI, Chinese governments not only provide capital to AI firms, but also create use cases that demonstrate the benefits of AI, thereby encouraging private firms to adopt AI.[156]Moreover, a higher share of Chinese individuals (76 percent) believe AI will have an impact on the entire economy than individuals in the United States (58 percent), France (52 percent), Germany (57 percent), Spain (55 percent), and the United Kingdom (51 percent).[157] The second potential explanation is that, compared with its Western counterparts, China’s techno-utilitarian culture is more willing to adopt AI if it provides a broader social good, even if some individuals believe there are ethical questions concerning AI.[158]

Indeed, Chinese individuals have many extremely positive views of AI while also believing in several negative implications. For example, more Chinese people (53 percent) believe that their job will no longer exist in the next ten years because of AI than people in the United States (26 percent), France (27 percent), Germany (27 percent), Spain (38 percent), and the United Kingdom (30 percent). This view, however, is counterbalanced by 91 percent of Chinese individuals believing AI will create new jobs, compared with 48 percent of U.S. individuals. Individuals in France (42 percent), Germany (37 percent), Spain (44 percent), and the United Kingdom (40 percent) were even less likely to believe AI will create new jobs in the next 10 years. Chinese individuals also believe in higher rates that AI will create more inequality between the privileged and underprivileged, and the educated and uneducated.[159]

U.S. Businesses Are Lagging in Conveying the Importance of AI to Their Employees

Chinese firms are doing a better job than U.S. firms of conveying the importance of AI to their employees. For example, 43 percent of U.S. individuals say their employers present the development of AI and the digital transformation of the organization as being strategically important, compared with 85 percent of Chinese individuals.[160] Regarding the development of AI and digital transformation, Chinese individuals are also more likely to expect their manager to make statements about the subject, hire new individuals because of it, increase the number of training courses for the topic, and launch new projects because of it.[161] Thus, it is unsurprising that the same survey found 54 percent of U.S. individuals responded that their workplace had no plan to deploy AI tools, versus 22 percent of Chinese individuals.[162]

Many EU Individuals Are Skeptical of AI

While U.S. firms may not be properly conveying the importance of AI to their employees, many EU individuals are outright skeptical of AI. As such, while the European Union is only slightly behind the United States in adoption, it is significantly behind China. Similarly, individuals in the European Union typically have more negative feelings toward AI in the workplace than workers in the United States, and significantly more negative feelings than employees in China. For example, a higher share of individuals in the United Kingdom (55 percent), Germany (61 percent), France (65 percent), and Spain (53 percent) cite at least one negative feeling when thinking about the consequences of AI regarding their work, compared with 51 percent and 24 percent of individuals in the United States and China, respectively.[163] Individuals in the European Union may lack enthusiasm for AI because they have had fewer positive experiences with it—77 percent and 91 percent of individuals in the United States and China reported AI tools having had positive implications for their effectiveness. Lower shares of French (62 percent), German (65 percent), Spanish (72 percent), and British (74 percent) people report similar feelings.[164]

Other surveys have found that Europe has shown less urgency to adopt AI. For example, a survey of executives found that 40 percent of European respondents thought AI “is still nascent and unproven,” compared with just 27 percent and 30 percent of North American and Asian-Pacific firms, respectively.[165] These trends represent correlations, not causes, and suggest a link between the adoption of AI and nations’ views of AI.

Data

AI systems often rely on vast quantities of data for training. Large datasets help AI systems develop highly accurate models to perform tasks ranging from navigating without a map to identifying faces to answering Google search queries.[166] Moreover, machine learning techniques allow AI systems to recognize subtle patterns in large datasets that are difficult or impossible for humans to perceive. This is one reason why many AI systems perform certain tasks better than human experts, such as identifying the signs of lung cancer in commutated tomography scans.[167]

Policymakers in China, the European Union, and the United States have recognized the importance of data. In 2015, to support the use of big data, China listed open data as one of ten national projects.[168] The EU’s coordinated plan on AI states, “AI needs vast amounts of data to be developed … The larger a data set, the better AI can learn and discover even subtle relations in the data.”[169] In the United States, President Trump’s American AI Initiative directs the government to “enhance access to high-quality and fully traceable federal data,” and directs the U.S.

Office of Management and Budget to identify and address data quality limitations.[170]

There is no straightforward metric for measuring the relative amount and value of data available for AI in a particular place. However, individuals produce a significant amount of data when they engage in various online and offline activities, such as using search engines, posting on social media, and making purchases. These activities produce data that can have enormous value for machine learning models. Therefore, one way to estimate the potential value of data in a country or region is to consider the percentage of the population that engages in digital activities.

This section measures the amount and availability of data in China, the European Union, and the United States concerning Internet activity, the Internet of Things (IoT), productivity (i.e., big data analytics), mobile payments, EHRs, genetics, and high-resolution maps. We also accounted for how regulations in a region may create barriers to data collection, access, and use. For some of these indicators, we have data to make direct comparisons. In others, we could not find directly comparable data. Consequently, we used a combination of quantitative and qualitative analysis to rank the regions first, second, and third.

In some cases, the most important measure is the percentage of the population participating in these activities. For example, using mobile-device locations to analyze traffic patterns in a certain location likely depends on having a critical mass both for accuracy and completeness of the model. In other cases, the total number of users is likely more important. For example, for drug development, it is likely more important to have the largest number of patients using EHRs than to have the largest percentage of patients. In some cases, this gives China a natural advantage given its larger population; however, it also suggests the European Union and United States should look to build population-level datasets that go beyond their borders.

We allotted this category 25 of 100 possible points. On an absolute basis, the most recent data available showed China leading (11.6 points), the United States (8.1 points) and the European Union (5.4 points). Controlling for workforce sizes, the United States led (11 points) China (7.9) and the European Union (6.2).

Fixed Broadband Subscriptions:Internet users generate data each time they browse the web, and AI systems can analyze this data to improve the effectiveness of advertisements. This indicator tracks the number of broadband subscriptions. As of 2018, China (394 million fixed broadband subscriptions) led the European Union (176 million) and the United States (110).[171] Per 100 people, the European Union (35 fixed broadband subscriptions) ranked ahead of the United States (34) and China (28).[172]

Table 32: Fixed broadband subscriptions, 2018[173]

Mobile Payments (2018): Consumers also generate data technology firms can analyze each time they use a mobile device to purchase a product. We define ”mobile payments” as using a mobile device to scan, tap, swipe, or check in order to make a point-of-sale transaction, which does not include purchases such as those of digital goods on mobile devices.[174] Over 525 million Chinese individuals were estimated to have made a mobile payment in 2018, compared with 55 million in the United States and an estimated 44 million people in the European Union.[175] An estimated 45 percent of the Chinese population used mobile payments in 2018, compared with 20 percent for the United States, 13 percent for the United Kingdom, and 8 percent for Germany.[176]

Table 33: Number of individuals using mobile payments, 2018[177]

Note: Data for the EU was only available for Germany and the United Kingdom.

IoT Data (2018): IoT devices can generate large amounts of data organizations can use to train machine-learning systems. These systems can then automate a wide range of tasks, from monitoring the health of railway tracks to dynamically controlling traffic lights that ease congestion to tracking pollution.[178] This indicator tracks the estimated amount of IoT data each region produced in 2018 in terabytes (TB). China (152 million TB) led the United States (69 million TB) and the European Union (53 million TB).[179] Per 100 workers, the United States (42 TB) led the European Union (21 TB) China (19 TB).[180]

Table 34: Amount of new IoT data generated, 2018[181]

Productivity Data (2018): Organizations are constantly generating data they can use as inputs to train their AI systems. For example, an airline can analyze its customer-, agency-, airplane-, and itinerary-map data to better control its flight costs.[182] This indicator tracks the estimated amount of productivity data, which is a combination of big data and meta data, each region produced in 2018. The United States (966 million TB) led China (684 million TB) and the European Union (583 million TB). Per 100 workers, the United States led (586 TB) the European Union (234 TB) and China (87 TB).[183]

Table 35: Amount of new productivity data generated, 2018[184]

Electronic Health Records: Researchers have used EHRs to develop AI systems that can perform a wide range of functions, from predicting whether patients will likely be hospitalized to helping track the spread of diseases.[185] Comprehensive data for China, all European Union member states, and the United States concerning EHR adoption was not available. However, a combination of quantitative and qualitative information suggests the United States has the greatest access to EHRs, ahead of the European Union and China. Consequently, the United States also leads in access per capita, followed by the European Union and China.

The adoption of EHR systems is relatively high in all the examined regions, but the availability to access EHRs across borders and between providers is not. For example, a 2015 survey found that the 84 percent of U.S. primary care physicians used EHR systems, compared with 99 percent of Swedish physicians, 98 percent of Dutch physicians, 98 percent of U.K. physicians, 84 percent of German physicians, and 75 percent of French physicians.[186]In China, a 2012 survey found that 48 percent of hospitals had basic forms of EHR systems.[187]Since 2012,the number of Chinese hospitals using electronic records may have grown to more than 90 percent.[188] In 2017, more than 96 percent of U.S. hospitals used certified EHR systems.[189]

Yet, in 2015, only 30 percent of U.S. hospitals could find, send, and receive EHRs to and from other providers.[190] Qualitative evidence suggests interoperability is even lower in China and the European Union. In China, hospitals frequently use EHR systems that are not interoperable, forcing patients to bring printed health records when seeing doctors in different hospitals.[191] In the European Union, the ability to access and share medical data across borders varies greatly, limiting the ability to train AI systems on cross-border data.[192] Indeed, many European citizens have no access to EHRs.[193]

Genetic Data: Another type of data that is useful to improving human health is genetic data. AI can analyze DNA sequences to find mutations linked to illnesses such as cancer and heart disease.[194] This indicator tracks the availability of genetic data from individuals in China, the European Union, and the United States. The United States, followed by China and the European Union, leads in absolute terms. Consequently, the United States definitively leads on a per capita basis. While it is difficult to compare China and the EU, China’s rising genetic testing industry and bans in the EU suggest China is ahead of the EU on a per capita basis.

As of 2017, more than 15 million U.S. consumers had purchased genetic testing kits, compared with 300,000 consumers in China.[195] And as of 2019, three U.S. firms—Ancestry.com, 23andMe, and Gene by Gene—had sold roughly 25 million testing kits.[196] Similar data for Chinese firms was not available, but it is known that 23Mofang, the largest of the more than 100 Chinese genetic testing companies, has more than 200,000 users.[197] In addition, several U.S. firms such as Gene by Gene, Veritas Genetics, and Full Genomes Corporation are sequencing entire human genomes, unlike many direct-to-consumer genetic testing companies that often analyze only 1 percent of the total genome.[198] These facts suggest U.S. firms have greater access to genetic data. In contrast, direct-to-consumer genetic testing bans in Germany and France, nations that account for roughly 30 percent of the EU’s population, suggests the United States and China are ahead of the European Union.[199]

High-Resolution Mapping Data: High-resolution mapping data is important to the development of numerous AI systems, including autonomous vehicles. This indicator tracks the availability of 3D elevation data—a 3D computer graphics representation of a terrain’s surface—at the 1-meter level. The United States leads in this indicator, followed by the European Union and China. Consequently, the United States, followed by the European Union and China, leads when controlling for the size of each labor force.

As of April 2019, there is 1-meter or better resolution data currently available or in progress for 45 percent of the United States.[200] In contrast, only 6 EU member states, representing approximately 15 percent of the geographic territory of the EU, provide public access to complete high-resolution 3D elevation data. The rest either provide partial coverage, low-resolution coverage, or do not make the data available to the public.[201] In China, the PRC Surveying and Mapping Law requires all entities performing mapping to have a license, which only 14 Chinese entities had obtained as of January 2018. Indeed, Chinese entities view the license as a “gold key” because it is difficult to obtain. The license requirement has the effect of only allowing 14 entities to produce autonomous driving maps.[202]

Regulatory Barriers: Data protection regulations may affect the amount of data available to organizations to train and use AI systems. Some data protection regulations, such as requirements for reporting data breaches, have little effect on the availability of data. Others, such as requirements to minimize data collection or retain data for limited periods of time, can have a significant impact on data availability. The EU’s General Data Protection Regulation (GDPR), which came into effect on May 25, 2018, has put constraints on the collection and use of data.[203]

We assessed how regulations in China, the European Union, and the United States affect the collection and use of data in each region. We believe the EU’s regulatory environment creates the most restrictions on the collection and use of data, followed by the United States and China. Consequently, China received three points, the United States received two points, and the European Union received one point for this indicator. Notably, our overall data rankings do not change when we remove regulatory barriers as an indicator.

We arrived at this ranking for several reasons. First, the GDPR has created an artificial scarcity of data by making it more difficult for organizations to collect and share data. The law regulates how organizations use or process the data of anyone living in the EU, and generally prohibits organizations from using data for any purposes other than those for which they first collected it. Indeed, Article 5 requires data be “collected for specified, explicit and legitimate purposes,” and “adequate, relevant and limited to what is necessary.”[204] These two restrictions—purpose specification and data minimization—significantly limit organizations innovating with data by restricting them from both collecting new data before they understand its potential value and reusing existing data for novel purposes. It is not always feasible for companies to know what data is most valuable or will yield the most important insights. Indeed, organizations often create new value by combining datasets, which makes it difficult to predict the future value of datasets at the outset.[205] By imposing stringent restrictions on the collection and use of data, the GDPR makes it more challenging for businesses to use the data consumers are creating.

Second, the United States has multiple federal data privacy laws, including sector-specific and state privacy laws.[206] For example, the Health Insurance Portability and Accountability Act (HIPAA) and the Family Educational Rights and Privacy Act (FERPA) impose multiple restrictions on the use of medical and educational records, respectively. In California alone, there are more than 25 privacy and data security laws, including the recently passed California Consumer Privacy Act of 2018, which will create substantial restrictions on how organizations may collect and use data when it comes into effect on January 1, 2020.[207] However, U.S. data privacy laws have not restricted organizations from collecting and using data as much as those in the EU.

Finally, China established a national standard on personal information protection in 2018. On paper, the standard is onerous.[208] Indeed, it requires organizations to only collect the minimum amount of data required, use it only for its original purposes, and retain it for the shortest amount of time necessary.[209] However, this standard is not legally enforced, and its drafters intended the standard to be more permissive and business friendly than the GDPR.[210] Nonetheless, China uses such national standards to develop laws, and Chinese legislators are in the process of drafting a law to protect national data privacy.[211] In addition, Chinese regulators have already begun to increase enforcement activities using existing laws, such as announcing a review of 1,000 mobile apps and threatening to revoke the business licenses of those that mishandle user data.[212]

Still, anecdotal evidence suggests Chinese companies face fewer restrictions on collecting and using consumer data than their U.S. and European counterparts.[213] Consequently, we ranked China’s regulations as the least restrictive. Moreover, Chinese companies have formed a number of partnerships with local government to collect data in public spaces, which laws in the United States and EU would often restrict.[214]

Interpretation: China Could Have A Bigger Data Advantage In The Future

China leads in both data collected and likely the amount of data available to large Internet firms, which are also the firms best leveraging AI. This fact, combined with multiple data deficiencies that changes in Chinese policies could alleviate, means China could have an even bigger advantage in the future.

Chinese Internet Firms Likely Have Greater Access to a Wider Variety of Data

Large Chinese Internet firms likely have a data advantage compared with their Western counterparts for at least two reasons. First, services in the West are relatively divided between firms. For example, Amazon users are able to buy groceries but not book a hotel. Chinese technology companies, on the other hand, have created all-in-one super apps. For example, Kai-Fu Lee has written that WeChat, an app owned by Chinese technology company Tencent, allows users to “hail a taxi, order a meal, book a hotel, manage a phone bill, and buy a flight to the United States, all without ever leaving the app.”[215] In the United States, these services, and thus the data, are divided between such firms as Uber, Postmates, Expedia, Verizon, and Venmo.[216]

Second, Chinese technology companies have embedded themselves in traditionally off-line activities. For example, Didi, the Chinese equivalent of Uber, has bought gas stations and auto repair shops. In addition, Meituan Dianping, whose origins are similar to that of Yelp, not only provides users with a platform to compare businesses, but also handles food delivery.[217] Chinese Internet companies are therefore afforded the opportunity to collect a greater variety and depth of data than their American counterparts.[218] It should be noted, however, that the broader global reach of some U.S. technology giants provides them with their own data advantage. For example, Facebook has more than 2 billion users, while WeChat has only 1.1 billion users. Should Chinese firms achieve more success internationally, such as with the social media video app TikTok, the U.S. advantage will diminish.[219]

China Is Not Close to Its Data Potential

China is also not fully taking advantage of the data it generates. For example, U.S. companies have been collecting structured data, such as loan repayment rates, for decades in industries such as insurance and finance.[220]But Chinese companies have been slower to adopt enterprise data storage, making it more difficult to extract insights and value from such data.[221] China is also behind its Western counterparts in creating standards that help organizations share data across platforms.[222] Government agencies have neglected fundamental standards on data collection, causing significant amounts of data to be unreadable by computers, thereby lowering the quality and usability of data for analysis.[223] China is behind its counterparts in making government data available to the public, despite listing open data as a national project in 2015, and local governments making some progress.[224] Finally, while other countries are benefiting from the increase of global cross-border data sharing, China’s Internet ecosystem remains closed, limiting the amount of data it shares and receives from foreign nations.[225] This “closedness” reduces the diversity of data Chinese companies collect.

Hardware

AI systems rely on semiconductor devices, such as integrated circuits, that can perform large numbers of operations per second. Indeed, graphics processing units (GPUs), which are circuits that perform mathematical operations in parallel, have catalyzed recent AI developments.[226] In addition, technologies such as supercomputers, which combine processing units such as GPUs and central processing units, can expand the capabilities of AI systems through massive computational power. For example, researchers have combined supercomputers and machine learning techniques to model climate change as well as the merging of blackholes.[227]

The aforementioned hardware is important to a nation’s AI competitiveness for several reasons. First, nations with a weak semiconductor industry can be vulnerable to the actions of other countries. For example, in 2018, the United States banned American companies from providing parts and software to ZTE, a large Chinese telecommunications equipment manufacturer. Due to ZTE’s reliance on semiconductor devices from U.S. firms, the company nearly folded. While the United States ultimately lifted the ban, the situation highlighted China’s dependence on Western technology.[228] More recently, the United States has blocked U.S. firms from selling chips to five specific supercomputing entities, and the U.S. Commerce Department has black listed Huawei, which prevents firms from selling U.S. technology to Huawei without a license.[229] Second, many experts believe AI chips designed specifically for AI applications, such as autonomous vehicles or facial recognition, will outperform such proven technologies as GPUs.[230] As a result, non-semiconductor firms, such as Apple, Alphabet, and Amazon, are designing their own AI chips to meet their specific needs, which could increase the performance of their AI systems and thereby provide them with a competitive advantage.[231] Third, high-performance computing has fueled breakthrough discoveries in several sectors, and access to the best performing supercomputers provides nations an advantage in developing leading-edge weapons systems and applications faster than other nations. [232]

This section analyzes China, the European Union, and the United States in terms of semiconductor sales, semiconductor R&D spending, the number of firms designing AI chips, the number of supercomputers ranked in the top 500 by performance, and the aggregate system performance of the supercomputers. We allotted this category 10 of the 100 available points. On an absolute basis, the most recent data available showed the United States leading in hardware (6 points), followed by China (2.5) and the European Union (1.5). Controlling for workforce sizes, the United States (7.6 points) led the European Union (1.5) and China (0.8).

Semiconductor Sales: This indicator measures the number of semiconductor firms in the top 15 globally for sales during the first quarter of 2019. The United States (6 firms) led the European Union (2) and China (1).[233]

Table 36: Number of firms in top 15 for semiconductor sales, 2019[234]