It’s crunch time for Germany and the European Central Bank. For close to a decade, the ECB has been cutting interest rates while urging member states that have funds for fiscal stimulus (read: Germany) to use them. The ECB grew increasingly desperate to stimulate the eurozone economy and raise inflation, and in 2015, it finally introduced its asset purchases program. It continued to urge the German government to act in order to support growth throughout the bloc, and Germany continued to refuse. From Berlin, things didn’t look so bad. The ECB’s easy money kept the value of the euro down, which gave a boost to German exports and the German budget, practically without Berlin having to lift a finger. Until the second half of 2018, the German economy was riding high, even as German politicians and bankers lamented the effect that the ECB’s low interest rates were having on German savers and bank profits.

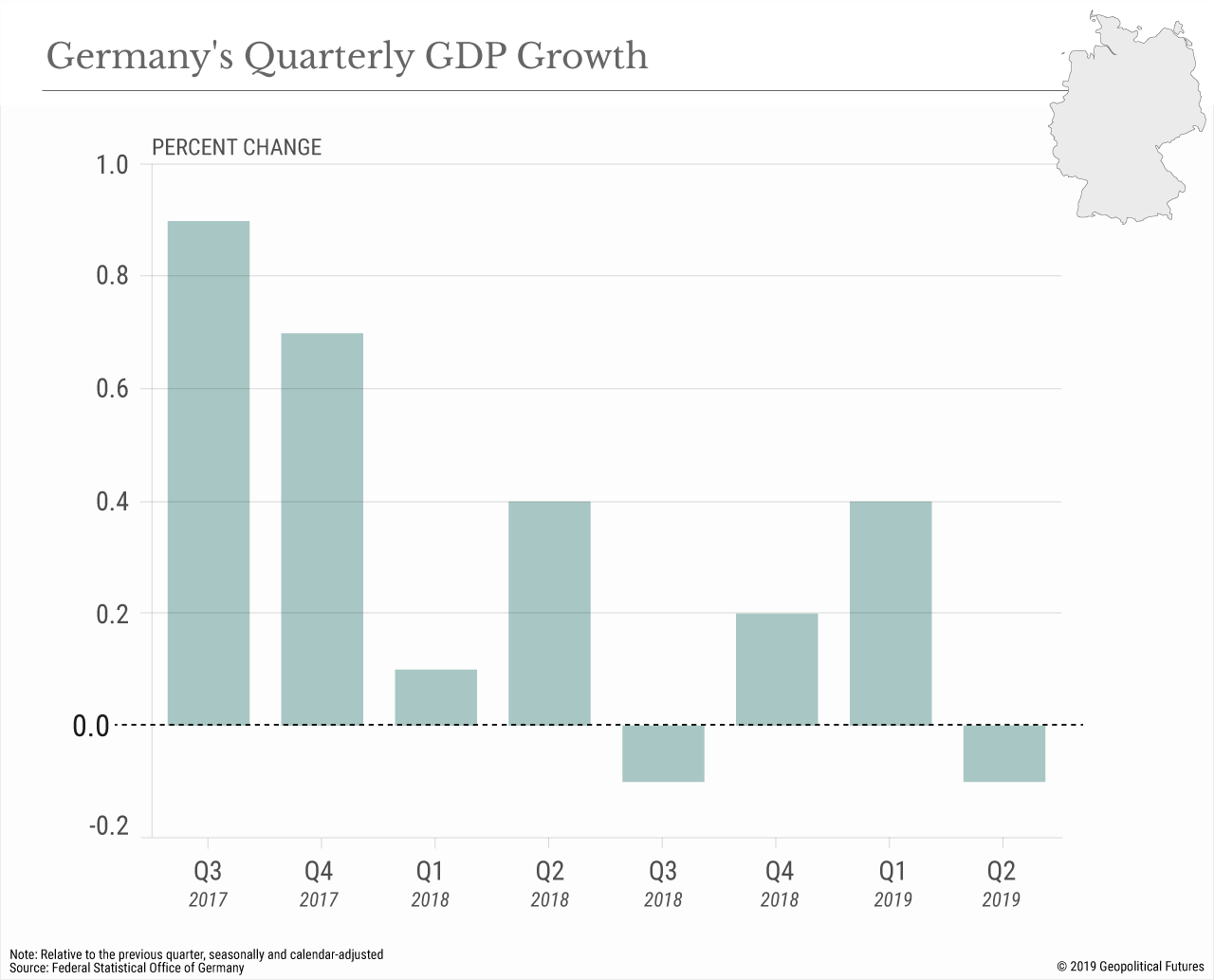

It’s crunch time for Germany and the European Central Bank. For close to a decade, the ECB has been cutting interest rates while urging member states that have funds for fiscal stimulus (read: Germany) to use them. The ECB grew increasingly desperate to stimulate the eurozone economy and raise inflation, and in 2015, it finally introduced its asset purchases program. It continued to urge the German government to act in order to support growth throughout the bloc, and Germany continued to refuse. From Berlin, things didn’t look so bad. The ECB’s easy money kept the value of the euro down, which gave a boost to German exports and the German budget, practically without Berlin having to lift a finger. Until the second half of 2018, the German economy was riding high, even as German politicians and bankers lamented the effect that the ECB’s low interest rates were having on German savers and bank profits.But now, Germany’s economy is slowing. China isn’t growing as quickly as before, while Brexit and the U.S.-China trade war (not to mention the threat of U.S. tariffs on European goods) have hurt business and consumer confidence. The Bundesbank, Germany’s central bank, wrote in its August monthly report that the economy was likely to slip into a technical recession in the third quarter. After all this time, the ECB’s dovish policies, intended to prop up struggling Southern European economies, are finally starting to make sense for the eurozone’s largest economy, too. There are just two problems: First, Germany’s monetary hawks, of which there are many, don’t yet see things that way. Second and more important, the ECB’s options for stimulus are almost entirely depleted. There’s a bit more that can be done, but not without stretching the limits of European Union law and agitating the already testy Germans. If the German economy is going to get a boost, it’ll need to come from within.

To Ease, or Not to Ease

At its last meeting in late July, the ECB Governing Council expressed its determination to act if inflation in the eurozone did not move closer to its 2 percent target. Investors came away expecting a further lowering of the rate charged on banks’ deposits with the ECB and a resumption of asset purchases, which were wrapped up only at the end of 2018.

The Governing Council meets again on Sept. 12, but Germany’s hawks are already fearing the worst and pushing back. Bundesbank President Jens Weidmann, in an interview last week with the Frankfurter Allgemeine Sonntagszeitung, criticized the tendency to look to monetary policymakers for major responses to every blip in the data. Sabine Lautenschlaeger, a German member of the ECB’s executive board, said it was too soon for a huge stimulus package. (The Dutch and Austrian central bank chiefs have voiced similar concerns.) The chief German economist at Deutsche Bank, Stefan Schneider, explained the German conservative perspective nicely, writing that “Anglo-Saxon” policymakers and economists were wrong to believe that smart policies could sustain economic expansions indefinitely. The last time a German government tried to outsmart market forces, he wrote, it ended up triggering the stagflation period of the 1970s and 1980s.

The German monetary hawks’ assessment is that the current slowdown is not yet a crisis and doesn’t have to become one if policymakers just keep their wits about them. The causes of the downturn are idiosyncratic and external: the U.S.-China trade war, China’s slowdown and uncertainty surrounding the United Kingdom’s departure from the EU. Those factors will work themselves out, confidence will rebound and growth will resume. And if the problems are all external, the solutions can’t be found internally – neither by monetary easing nor by a decision by Berlin to issue new debt. Only if the recession lingers or deepens should authorities jump into action.

The ECB, which was modeled after the Bundesbank but philosophically has resembled it less and less since the eurozone crisis began, doesn’t see things the same way.

But its toolkit is nearly empty. The central bank’s main refinancing rate is already at zero percent. The deposit rate has been at minus 0.4 percent since March 2016, and there’s little expectation that deeper cuts would have much effect on growth. More attention has focused on the central bank’s asset purchases program, particularly the 2.1 trillion-euro ($2.3 trillion) Public Sector Purchase Program, which involves buying government bonds. The ECB’s self-imposed issuer limit caps its holdings of each country’s debt at 33 percent to prevent the central bank from gaining a blocking minority (which would enable it to vote down future restructuring proposals) and to defend it against charges that the program amounts to monetary financing, which is banned under EU law. Reuters estimates that the ECB already holds 30 percent of German, Dutch and Finnish government debt. With this in mind, the ECB is reportedly considering raising the limit to 50 percent, which would surely spark legal challenges in Germany. Indeed, one such challenge is still working its way through the German Federal Constitutional Court. A ruling against the ECB would be unexpected, but if it were to happen, it might force the Bundesbank to cease participation in the Public Sector Purchase Program, potentially endangering the whole program.

The Fiscal Option

If monetary policy options are almost tapped out, Berlin may have no choice but to open the fiscal spigot – if, fiscally conservative policymakers caution, the recession deepens or lingers. Outside of Germany, calls for the government to do something – invest more in physical and digital infrastructure and climate protection, cut taxes, reduce barriers to investment, etc. – have reached a fever pitch. In recent months those calls have even spread inside Germany itself.

The German government started hinting at greater flexibility on spending early last month. An unnamed senior government official told Reuters in early August that Berlin may scrap its commitment to balanced budgets in order to finance a climate protection program. A high-ranking member of the Social Democratic Party, the junior partner in Germany’s governing coalition, reportedly said the balanced-budget policy was untenable. The following week, officials in the chancellery and Finance Ministry told German weekly magazine Der Spiegel that Chancellor Angela Merkel and her finance minister were prepared to set principle aside and take on new debt to stabilize the economy in a crisis. Days later, Finance Minister Olaf Scholz attached a number to the rumors: 50 billion euros, the same size, he said, as the stimulus plan Berlin put together in 2009. (In fact, it is the size of Germany’s second stimulus package. Two other packages in 2008 and 2009 totaled 11 billion euros and 8.5 billion euros, respectively.)

The days when the ECB’s easy money policies can prop up German exports – or the eurozone economy – seem to be coming to a close. Gradually, the German political establishment is recognizing that the country’s economy needs a boost and that no salvation is likely to come from outside sources (quite the opposite – U.S. car tariffs could hit later this year), or indeed from that central bank that it loves to hate. In the short term, tax cuts, which are already in the works, and stimulus measures like the 2009 “cash-for-clunkers” car scrappage scheme can help. But decades of underinvestment have taken their toll. The good news for Germany is that its years of scrimping have given it significant fiscal room to maneuver. Higher levels of spending in Germany would be a relief for other European economies and would take some of the pressure off the ECB. The bad news is that not everyone agrees that action is warranted, and even among those who do, there’s no consensus that German policies contributed to the slowdown in the first place.