By George Friedman

Global recessions tend to have a broad and powerful core. The recession in the 1970s was triggered by the Arab oil embargo. The one in 2008 was caused by the subprime mortgage crisis. Such events put simultaneous pressure on a wide range of countries and can trigger a global recession. Today, several economies are showing signs of an approaching recession. There’s no obvious trigger for a global recession at this time, but multiple countries appear to be headed toward a recession or a significant economic slowdown. Chief among them are the United States, China and Germany.

In the United States, many observers are focused on the inverted yield curve, which certainly has a strong track record of indicating recession. The more interesting light that has been flashing is the unemployment rate. It has been at what is considered full employment for a while. This is somewhat misleading, however, because a significant percentage of the population remains jobless – those who have stopped looking for work or those who are too ill to work are not counted in unemployment figures. In July, the labor force participation rate stood at only 63 percent. Even if we accept that the unemployment rate is currently at 3.7 percent, it is not necessarily a sign of a healthy economy. To grow an economy, a country must have fresh, qualified labor. With a relatively low unemployment rate, the U.S. doesn’t seem to have that in sufficient quantity. That, coupled with the normal inefficiencies that creep into an economy over a decade of economic expansion, indicates that a cyclical downturn seems likely.

China’s economic system was badly hurt in 2008 and never fully recovered. China depends on exports, but during the financial crisis, global demand decreased. As a result, there has been ongoing financial dislocation that has never been satisfactorily resolved. Combine this with the tariffs imposed by China’s biggest customer, the United States, and the country has major problems. China derives 4 percent of its gross domestic product from exports to the United States, while the U.S. derives about 0.5 percent of its GDP from exports to China. Certainly, U.S. companies like Apple depend on China for both production and consumption, and a slowdown there will be reflected on their balance sheets. But the consequences will be felt in China, not the United States. China has failed to clean up its economy, and 10 years after the crisis, a time of reckoning is likely.

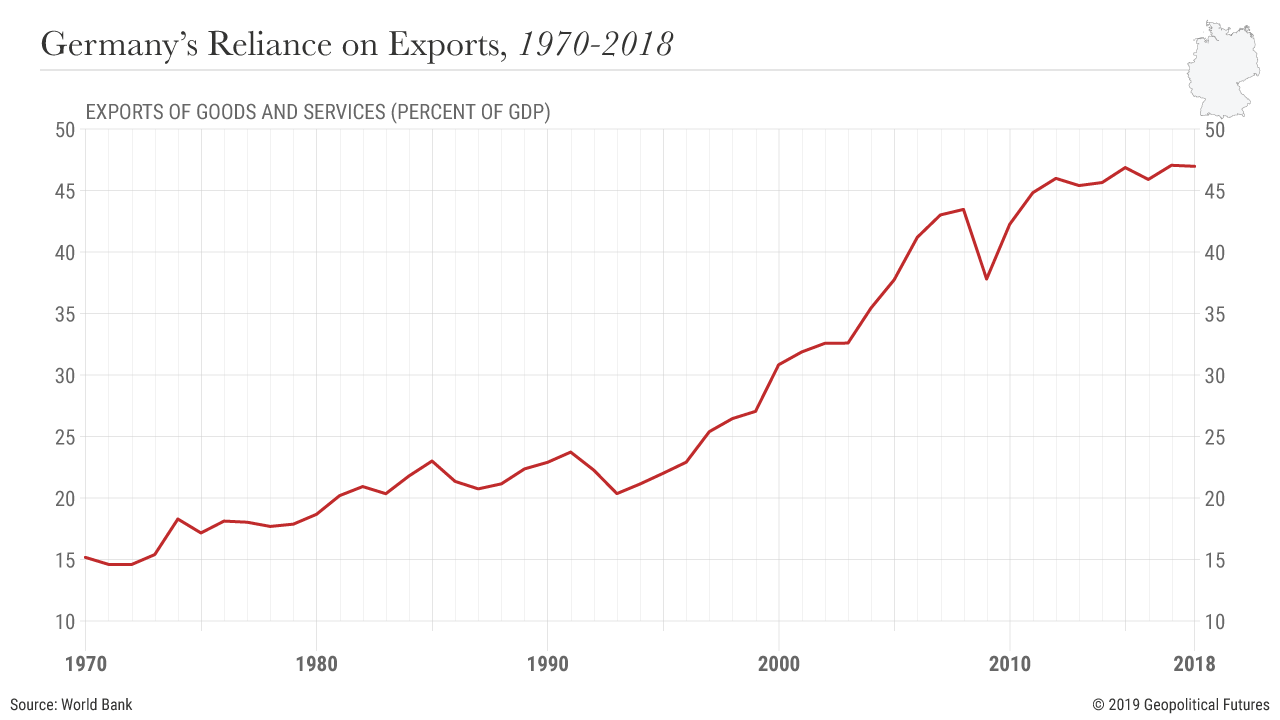

Germany is the closest to slipping into the classic definition of recession. I have previously expressed a great deal of concern about Germany’s position, as exports account for nearly 50 percent of its GDP – a staggering amount for the fourth-largest economy in the world and a number that makes it very vulnerable to minor belt-tightening in other countries. This creates two different risks. The largest single buyer of German exports is the United States, and if the U.S. slips into recession, it will purchase fewer imports. If Germany moves into a recession, it won’t be able to buy from its customers in the rest of Europe. These countries depend heavily on their exports to Germany, so if the German economy contracts, the rest of Europe will also suffer. Europe’s banking system is also in trouble, with the introduction of negative interest rates, the European Central Bank keeping a close eye on banks likely to fail, and post-2008 restructuring programs struggling to garner positive results. These are troubling signs considering that banks are seismographs of the economy.

It’s important to emphasize that there are no signs of a looming global recession. The economic problems in all three of these major economies are not triggered by a single cause. Instead, we have purely national explanations arising at about the same time. In addition, 10 years have passed since the last major recession, and these countries are due for another one. The important question is whether we are wrong in thinking that this will be a relatively manageable recession. With three of the top four economies in the world all facing slowdowns at the same time, the cause is less important than the feedback effect between the economies. A simultaneous downturn in different countries triggered by different reasons is in a way more dangerous than one sparked by a single factor. A recession caused by a single event can be dealt with, but how do you deal with different economies that have different problems? China and Germany need to export more. The U.S. wants to import less. The solutions to each of these countries’ economic problems may grind against each other. From my point of view, which is different from an economist’s point of view, these recessions may not have a single, elegant solution.