Hackers Are Conducting Double Spend Attack On Cryptocurrency Exchanges And The Latest Victim Is Bitcoin Gold.

It is claimed that cryptocurrencies operate a lot more privately and safely than traditional currencies. But, it has been observed time and again that the security measures used to safeguard cryptocurrency are lackluster and benefit cybercriminals greatly.

So far, quite a few incidents have been associated with cryptocurrencies. Despite the low number of hacking sprees involving cryptocurrencies, it is a fact that hacking of virtual coins is a reality – The latest victim of one such incident is Bitcoin Gold.

Recently, an attack was successfully deployed against Bitcoin Gold currency in which a miner executed a double spend attack on Bitcoin Gold token network. Due to the attack, millions of dollars were lost and several exchanges that traded the coin were affected.

Reportedly, an unknown party having access to massive amounts of hashpower is attempting to use 51% attacks. BTG or Bitcoin Gold forum tracked the hack until the previous week to monitor the controversial hashrate and concluded that a 51% attack was indeed underway. The information was posted by BTG poster Mental Nomad about a week back.

See: Coincheck cryptocurrency exchange hacked; $534 Million stolen

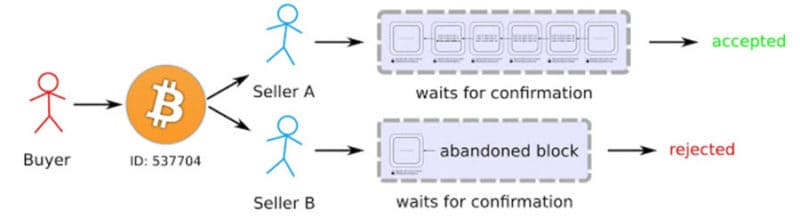

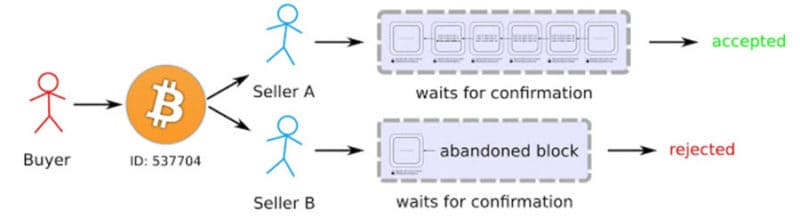

The purpose identified for this attack was to perform “double spend” attack, which involves stealing money from Exchanges. On May 18, Director of Communications Edward Iskra released a warning to caution users.

“We have been advising all exchanges to increase confirmations and carefully review large deposits,” read the message from Iskra.

In the said case, the miner acquired control of the entire blockchain by obtaining over half (that is, 51%) of the network’s hash power. Although Bitcoin Gold is a tiny coin in the virtual currency market, it is currently rated as the number 26th therefore, acquiring over half of the hash power of a network requires a considerably high amount of money, which in this attack probably was created while deploying a double spend attack.

The hacker immediately started to deposit funds on various exchanges after gaining majoritarian control of the network. Coins that were previously transferred to a wallet controlled by the exchanges were also simultaneously transferred. Blockchain could have resolved the issue of double spend but given that the hacker had acquired control of the network, it became possible to transact and reverse the operations later on.

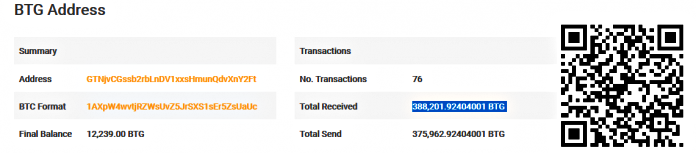

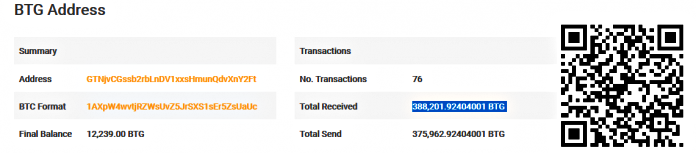

Approximately 18 million dollars got stolen during the attack. The sum was collected from different exchanges. One of the accounts was found to be involved in the attack and it received 388,200 BTG tokens on Monday, 16th May.

The attacks stopped on May 18th but there is still a chance for the hacker to launch another attack provided that he manages to control the majority of the network’s hash power once again. It is worth noting that BTG is the third altcoin to be attacked in the last week. Previously Monacoin and Verge (XVG) cryptocurrencies were also attacked.

Mental Nomad states that such attacks are quite interesting because: “There is no risk to typical users or to existing funds being held. The only parties at risk are those currently accepting large payments directly from the attacker. Exchanges are the primary targets.”

See: Hackers steal $30 million worth of cryptocurrency in Tether hack

He further noted that apparently the attacker is deterred for now due to the actions taken by exchanges.

Bitcoin Gold team members are communicating with exchanges because according to BTG it is important to improve safety.

“Until now, some Exchanges were operating with less than five confirmations required. We have been urging higher limits to prevent such an attack, and urging manual review of large deposits of BTG before clearing the funds for trading,” states BTG.

All we can say is that cryptocurrencies are here to stay and have substantially transformed the mechanisms of the financial industry. However, it is important to develop safer and stronger platforms that support the crypto’s claim of security comprehensively. Exchanges are specifically vulnerable because of coveting large deposits that further enhance the problems in such cases.

It is claimed that cryptocurrencies operate a lot more privately and safely than traditional currencies. But, it has been observed time and again that the security measures used to safeguard cryptocurrency are lackluster and benefit cybercriminals greatly.

So far, quite a few incidents have been associated with cryptocurrencies. Despite the low number of hacking sprees involving cryptocurrencies, it is a fact that hacking of virtual coins is a reality – The latest victim of one such incident is Bitcoin Gold.

Recently, an attack was successfully deployed against Bitcoin Gold currency in which a miner executed a double spend attack on Bitcoin Gold token network. Due to the attack, millions of dollars were lost and several exchanges that traded the coin were affected.

Reportedly, an unknown party having access to massive amounts of hashpower is attempting to use 51% attacks. BTG or Bitcoin Gold forum tracked the hack until the previous week to monitor the controversial hashrate and concluded that a 51% attack was indeed underway. The information was posted by BTG poster Mental Nomad about a week back.

See: Coincheck cryptocurrency exchange hacked; $534 Million stolen

The purpose identified for this attack was to perform “double spend” attack, which involves stealing money from Exchanges. On May 18, Director of Communications Edward Iskra released a warning to caution users.

“We have been advising all exchanges to increase confirmations and carefully review large deposits,” read the message from Iskra.

In the said case, the miner acquired control of the entire blockchain by obtaining over half (that is, 51%) of the network’s hash power. Although Bitcoin Gold is a tiny coin in the virtual currency market, it is currently rated as the number 26th therefore, acquiring over half of the hash power of a network requires a considerably high amount of money, which in this attack probably was created while deploying a double spend attack.

The hacker immediately started to deposit funds on various exchanges after gaining majoritarian control of the network. Coins that were previously transferred to a wallet controlled by the exchanges were also simultaneously transferred. Blockchain could have resolved the issue of double spend but given that the hacker had acquired control of the network, it became possible to transact and reverse the operations later on.

Approximately 18 million dollars got stolen during the attack. The sum was collected from different exchanges. One of the accounts was found to be involved in the attack and it received 388,200 BTG tokens on Monday, 16th May.

The attacks stopped on May 18th but there is still a chance for the hacker to launch another attack provided that he manages to control the majority of the network’s hash power once again. It is worth noting that BTG is the third altcoin to be attacked in the last week. Previously Monacoin and Verge (XVG) cryptocurrencies were also attacked.

Mental Nomad states that such attacks are quite interesting because: “There is no risk to typical users or to existing funds being held. The only parties at risk are those currently accepting large payments directly from the attacker. Exchanges are the primary targets.”

See: Hackers steal $30 million worth of cryptocurrency in Tether hack

He further noted that apparently the attacker is deterred for now due to the actions taken by exchanges.

Bitcoin Gold team members are communicating with exchanges because according to BTG it is important to improve safety.

“Until now, some Exchanges were operating with less than five confirmations required. We have been urging higher limits to prevent such an attack, and urging manual review of large deposits of BTG before clearing the funds for trading,” states BTG.

All we can say is that cryptocurrencies are here to stay and have substantially transformed the mechanisms of the financial industry. However, it is important to develop safer and stronger platforms that support the crypto’s claim of security comprehensively. Exchanges are specifically vulnerable because of coveting large deposits that further enhance the problems in such cases.